Africa’s Fintech revolution continues to accelerate with the official launch of Ultra App, a bold new player offering users the ability to seamlessly manage everyday finances, fund virtual accounts, pay bills, and now swap and buy cryptocurrencies all in one App.

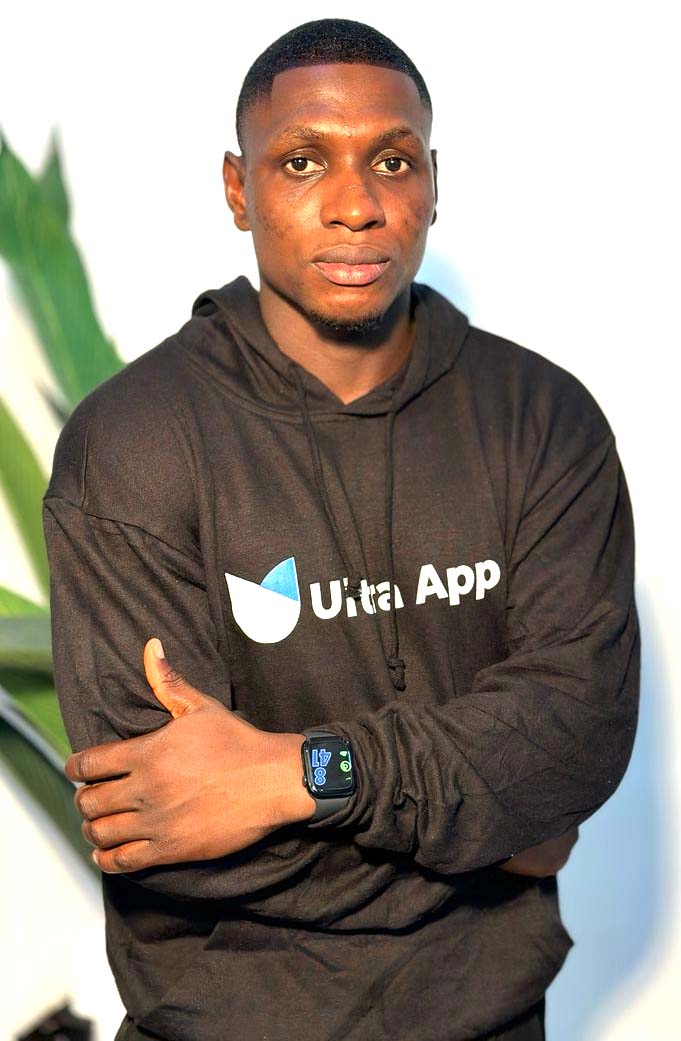

At the helm is visionary CEO and Co-founder Thankgod Izime, whose tech-driven passion and international business acumen are now fueling one of the most promising Fintech innovations in the region.

Built for the modern user, Ultra App provides a clean and intuitive interface where users can create and fund virtual accounts for secure payments and instant money transfer to other Nigerian banks. Move funds between users effortlessly within the Ultra App for zero-fee, no hidden charges.

Bill Payments like buying airtime, mobile data, pay electricity bills, fund Bet accounts, and renew cable TV subscriptions—all from your phone.

Users can buy cryptocurrencies using Naira and instantly swap crypto to Naira, bridging the gap between traditional and digital finance in real-time and also avoiding P2P method.

According to him, “we created Ultra to give people true control over their money—whether it’s sending a simple transfer or accessing global digital assets. Our platform is fast, clean, and built on how people actually live and transact today”.

However, Thankgod Izime is a young Nigerian with a Bachelor’s degree in Computer Science from Nigerian University and a Master’s in International Business from the University of Greenwich in the United Kingdom. His combined tech background and global business perspective form the backbone of Ultra’s product design and growth strategy.

Under his leadership, Ultra App isn’t just another payment app, it’s a gateway to smarter finance,

crafted for African users who demand speed, versatility, and simplicity.

Again he said, “We aim to highlight the benefits of DeFi while addressing one of its biggest adoption barriers: the steep learning curve. Many users are still hesitant to engage with DeFi due to its complexity. Ultra plans to bridge this gap by introducing DeFi concepts through familiar TradFi (traditional finance) experiences, making it easier for everyday users to onboard and interact with decentralized financial products. Like, borrowing and lending cryptocurrencies, save crypto and get interest for just holding cryptocurrency and also a crypto debit card”.